My contrarian instincts commonly begin when I see the group getting to a suspicious agreement. Most of the moment, what the group does IS the market; what they state, nevertheless, is commonly suspicious.

Over the previous couple of years, the group has anticipated fast Federal Book price cuts that never emerged; there were repeated expectations in 2022,’ 23, and’ 24 of an impending economic downturn that never ever happened; the concerns caused by market concentration appear to have also been overlooked by Mr. Market.

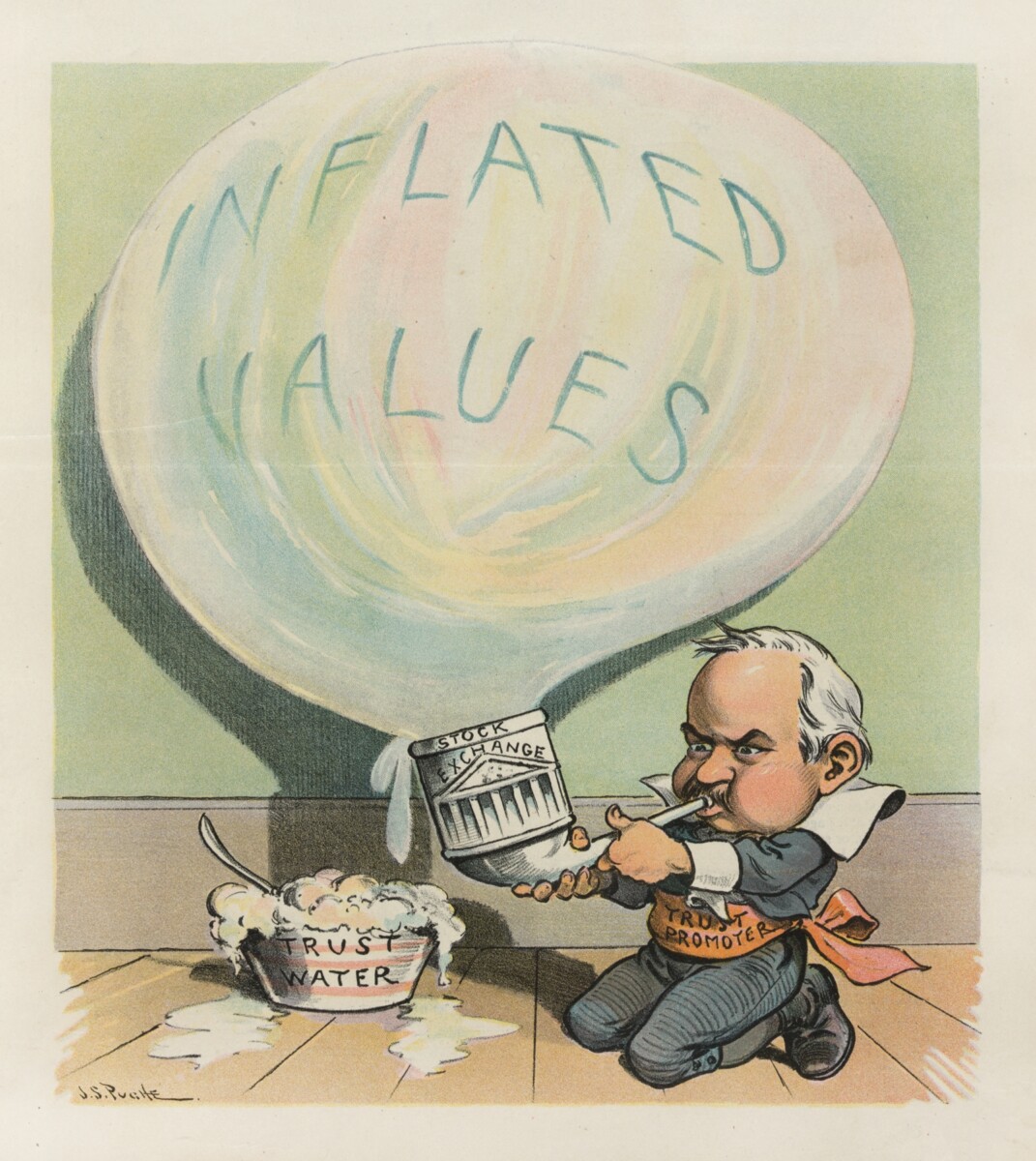

Then there is the countless cacophony of bubble babble.

I can not recall ever before listening to the group recognize a bubble in actual time, and afterwards there really a) being a bubble that b) ruptured not long after. Necessarily, the group creates bubbles via a combination of psychology, greed/FOMO, excess liquidity, and sheer foolhardiness.

Back in 2011, I tried to produce a list of just how to identify a bubble in real-time With the benefit of time and knowledge, it is simple to see the impact of the Great Financial Crisis on that particular checklist. It is 14 bullet quantitative points that need to enable you to see if any market is exhibiting bubblicious propensities.

Let’s undergo those 14 indicate see just how they stand up today:

Standard Variances of Evaluation : Markets are costly, yet not Japan 1989/ 1999 – 2000 Dotcom costly

Significantly raised returns : The previous 15 years have actually seen returns of 16 % every year. This is the third-best rolling 15 -year duration given that WW 2, but it likewise complies with a 57 % GFC collision. The previous two years 25 % annually. 2023 – 24 absolutely counts as raised.

Excess utilize : While there are some leveraged products put there like 2 X and 3 X ETFs, it is hardly a meaningful quantity of resources (the same was said concerning Subprime, however that was hugely infiltrated throughout the whole of the monetary system)

New monetary products : Alts? Exclusive Credit report? Neither is a lot “New” as recently preferred.

Expansion of Credit : Mainly tight, not extremely readily available.

Trading Quantities Spike : NYSE typical daily trading quantity (ADV) is about 1 36 billion shares– somewhat over historical average of 900 million to 1 2 billion shares each day. NASDAQ average everyday volumes has actually surpassed 9 billion shares via 2025 ADV varies 6– 8 billion shares daily, so task this year is well above standard.

Depraved Rewards : I am not familiar with a lot below apart from the land grab in alts, the huge variety of new ETFs, and the return of meme supply trading.

Tortured rationalizations : These are ever-present, however there has been some uptick recently.

Unplanned Consequences : Have yet to totally take place.

Employment patterns : Full employment is countered by eye-watering wages for AI engineers.

Credit score Spreads : Are really limited, and make me wonder why anybody would certainly intend to have HY when IG is nearly the very same prices

Credit scores Specification : Still tight since the GFC.

Default Fees : Low, but relocating greater in cars, credit card, mortgage however particularly pupil funding financial debt.

Unusually Low Volatility : VIX atr 20 is not specifically contented; as we saw in April, VOL has actually been quick to react to any kind of problem …

So while there are some indications of bubblicious activity, it is barely frustrating or seriously determinative in my sight. Stocks are expensive, but this appears less like a bubble and even more like a later phase booming market cycle.

Earlier this year, I noted what a marvelously underappreciated 15 years we have taken pleasure in. The bubble talk resembles a great deal more of the same …

Bear in mind, Greenspan’s “Irrational Vitality” speech was December, 1996 All advancing market run additionally, much longer, and greater than most anticipate …

Formerly :

Checklist: Exactly How to Find a Bubble in Real Time (June 9, 2011

A Stunningly Underappreciated 15 Years (April 28, 2025

Realtime Bubble List

1 Basic Inconsistencies of Assessment: Look at conventional metrics– assessments, P/E, price to sales, and so on– to increase two and even 3 basic deviations far from the historic mean.

2 Substantially elevated returns: The S&P 500 returns in the 1990 s were much beyond what one can sensibly anticipate on a lasting basis. The years around Greenspan’s “Irrational Vitality” speech recommend that a bubble was creating:

1995 37 58

1996 22 96

1997 33 36

1998 28 58

1999 21 04

And the Nasdaq numbers were even better.

3 Excess leverage: Every terrific economic bubble has at its origin gravy train and rampant speculation. Discover the utilize, and speculation won’t be too much behind.

4 New economic items: This is not an adequate problem for bubble, however it does appears that each major bubble has brand-new products somewhere in the mix. It may be Index funds, derivatives, tulips, 2/ 28 Arms.

5 Expansion of Credit rating: This is past simple speculative leverage. With great deals of money drifting around, we eventually navigate to moneying the general public to assist blow up the bubble. From Bank card to HELOCs, the 20 th century was when the public was invited to take advantage of up.

6 Trading Volumes Spike: We saw it in equities, we saw it in by-products, and we have actually seen it in homes: The transaction quantities in every significant boom and bust, almost necessarily, increases dramatically.

7 Corrupt Rewards: Where you have unaligned motivations in between business employees and investors, you get depraved results– like 300 home mortgage business blowing themselves up.

8 Tortured justifications: Try to find silly explanations for the new standard: Price to Clicks proportion, accumulating eyeballs, Dow 36, 000

9 Unplanned Effects: All legislation has unexpected and undesirable adverse effects. What current (or not so recent) regulations may have produced an unexpected and strange outcome?

10 Employment trends: A large increase in a given area– real estate brokers, day investors, etc– may be a clue regarding an establishing bubble.

11 Credit Spreads: Search For a very low spread in between legitimately AAA bonds and greater producing scrap can be indicative of set revenue danger cravings running as well hot.

12 Credit Score Specifications: Reduced and dropping loaning requirements are constantly a forward indicator of debt trouble in advance. This can be part of a bubble psychology.

13 Default Rates: Really reduced default prices on corporate and high yield bonds can suggests the simplicity with which even badly run business can refinance. This recommends excess liquidity, and creates incorrect complacency.

14 Uncommonly Low Volatility : Low equity volatility readings over an extended period indicates equity capitalist complacency.