This is a 2nd component of a yet unknown overall, where I investigate possible new plan programs, which are made to fulfill the difficulties that Japan is dealing with in the instant period and the years to come. This is also in the context of the altitude of Ms Takaichi to the LDP presidency and soon Prime Minister. She has actually suggested that her plan schedule will change somewhat from the existing federal government setting, in the sense that she wants reduced rate of interest, while most of economic experts desire greater, and she is supporting further monetary growth, while the mainstream desire austerity. In the first part I checked out the inflation issue in Japan, which recommends that the mainstream view that rates need to increase is illinformed. Today, I am thinking about the range for financial expansion.

The collection until now;

1 Japan– the challenges facing the new LDP leader (October 6,2025

2 Japan– the challenges facing the brand-new LDP leader– Part 2 (October 9,2025

Ms Takaichi is an advocate of Abenomics, which was specified by a dedication to durable financial activism and low interest rates, with the Bank of Japan maintaining federal government bond yields close to zero using its substantial bond-buying program.

In 2015, the brand-new leader informed the Bank of Japan that it was “silly to elevate rate of interest currently” and she has constantly verbalized a sight that rate of interest need to not be used as a counter-stabilising plan tool ( Resource

Among her present consultants is a colleague of mine at the College and we have released several posts and publications together.

Consequently, the plan recommendations is fairly constant with Modern Monetary Theory (MMT), although she is likewise obtaining input from mainstream economists.

But the combination of stable reduced interest rates (that is, de prioritising monetary policy as a device to manage the financial cycle) and a commitment to make use of bold financial policy interventions to attain full employment and product success is clearly even more MMT than an expression mainstream New Keynesian orthodoxy.

The other intriguing aspect of her strategy is recorded by her declaration at the press seminar upon handling the LDP management:

The federal government ought to take responsibility for monetary policy … (the federal government) … should communicate carefully with the BOJ.

Over the recently, there has actually not been a great deal of commentary focused on this facet of her approach, yet as I signified in Monday’s article, this challenges among the shibboleths of conventional New Keynesian thinking, which has led all of us to believe that ‘reserve bank freedom’ is non-negotiable and calls for no political influence on financial plan.

I have actually considered this problem prior to in these messages among others:

1 The reserve bank self-reliance myth continues (March 2,2020

2 Censorship, the reserve bank self-reliance ploy and Groupthink (February 19,2018

3 The sham of central bank self-reliance (December 23,2014

4 Central bank independence– one more synthetic schedule (May 26,2010

5 Senior mainstream financial expert currently admits central banks are not as independent as lots of believe (June 3,2024

The point is that the independence narrative was part of the depoliticisation schedule going along with the neoliberal requisition of federal government.

It permitted chosen governments to move the blame for rate of interest increases (and the political fall-out) away from itself by claiming that the financial plan authority was ‘independent’ from government and so on.

Certainly, there is no independence.

The chosen government usually selects the senior officials of the central bank so the appointments are political and the history of the RBA board confirms that clearly.

Extra notably, the reserve bank and the treasury divisions for each and every country should interact every day because financial decisions have effects for the liquidity in the system, which, consequently influences the state of the books that banks hold in their accounts at the central bank, which, consequently, identifies what the central bank does in order to take care of that liquidity to guarantee it is consistent with their present financial policy stance.

If that all seem like gibberish then I advise you to go back and read a few of the messages I have linked to above to get the much more thorough explanation which will remove it all up for you.

The lower line is that at the operational degree there can be no self-reliance in between the reserve bank and the treasury– both macroeconomic policy arms become part of the consolidated federal government field and must collaborate for policy consistency to take place.

The fascinating factor though is that Ms Takaichi is coming out openly regarding this and making it clear that monetary plan must be the obligation of the elected government and not handed over to unelected and mainly unaccountable technocrats.

That is a marked departure from the orthodoxy.

Where I depart with Ms Takaichi’s mentioned objectives are that she looks for to:

… prioritize financial growth.

I have written prior to concerning how Japan ought to lead the world in showing us exactly how to attain a sustainable degrowth trajectory while still guaranteeing the product demands of its people are fulfilled.

For instance:

1 Degrowth and Japan– a shift in government technique in the direction of service failing? (July 17,2024

2 Japanese federal government investing greatly in technologies to help its population age (October 21,2024

With an ageing population, a resistance to large-scale immigration, there are now considerable restraints showing up in the work market in regards to offered skills and so on.

As I have noted prior to, over 70 per cent of SMEs, which control the economy, are owned by those who typically more than 70 years age.

And there is a resistance to marketing those organizations on the competitive market when the owner obtains too old to run them– in favour of passing them down within the family.

Nonetheless, increasingly the youngsters do not want to continue the household organization practice and so business close when the aging proprietor is done.

So as opposed to combat versus the group fact, which is on-going and challenging to turn around within the dominant society, it would certainly be extra reasonable to establish a degrowth method.

Also if we did not hold that degrowth proneness, it stays to ask just just how much capacity there is within the present productive resource accessibility to accommodate substantial economic development anyhow.

I ask that concern due to the fact that to advocate raising the monetary shortage indicates that the federal government thinks there is genuine source area offered to absorb the increased nominal costs without provoking demand-pull inflationary stress.

So I am doing some research study on that particular inquiry and this is the initial take on the available evidence.

I will create more about this topic as my research study broadens.

The Financial institution of Japan publishes a quarterly time collection– Outcome Void and Prospective Growth Price — and the most recent information came out on October 3, 2025

This information gives some proof we can bring into play to help us identify the ‘growth space’ readily available to the Japanese federal government.

The technological paper underlying this data is– Approach for Approximating Outcome Gap and Potential Development Rate: An Update (released May 31,2017

I will not enter into the technological information however I have covered the deficiencies of standard result space method.

For instance:

1 The NAIRU/Output gap rip-off reprise (February 27,2019

2 The NAIRU/Output void rip-off (February 26,2019

3 The dreadful NAIRU is still around! (April 16,2009

4 NAIRU concept avoids good macroeconomic policy (November 19,2010

5 Structural shortages– the wonderful con job! (May 15,2009

6 Structural shortages and automated stabilisers (November 29,2009

My own PhD job was, partly, concerning this exact problem and my work as a 4 th year pupil at the University of Melbourne (1978 was, partially, about these concerns.

The idea of an outcome gap is conceptually sound– it is quite clear that we can conceptualise some prospective outcome level past which the efficient system can not press any more actual output without extra source ability being added (capital, labour, land, etc).

The step of current manufacturing is clear enough although actions of GDP want for what they consist of (for example, pollution) and omit (for instance, home manufacturing).

It is additionally fairly understandable the concept of a macroeconomic equilibrium joblessness degree where the contrasting distributional small revenue insurance claims between employees, capital and government correspond, albeit for a transitory period, with the real outcome offered for circulation.

My PhD (and early publications) were, in part, about theorising and operationalising this concept with a path-dependent system.

Nevertheless, as they say, the adversary remains in the detail.

We understand that ideology distorts the measurement process and the empirical expression of academic ideas.

Allow me discuss.

The Bank of Japan creates that:

The result space is the economic procedure of the distinction in between total need as an actual output of an economic situation and ordinary supply ability, ravelled for the business cycle– particularly potential GDP– … in the goods and services market of the nation. The possible growth rate is the yearly rate of change in prospective GDP. In variable markets, the result space shares the differential between the labor and resources use rates and their typical previous levels. The prospective development price is the amount of the ordinary growth of labor input and capital input, and the efficiency with which these factors are made use of, specifically complete aspect productivity (TFP).

Taken at face value, this is uncontroversial, although the absence of any type of biophysical facet on the conceptualisation of possible GDP growth prices is a severe and known shortage.

However, basically, the output void concept is understandable.

The problem is that ‘possible GDP’ is not conveniently measurable and needs us to take a stand on what constitutes complete capacity exercise of work and resources.

This is where ideological background gets in the image.

What comprises full work of labour?

In the context of the optimal result that might be ejected it needs to imply having everyone working up to their desired hours.

Nonetheless, that is not the way the mainstream specify complete work.

They think about the Non-Accelerating-Inflation-Rate-of-Unemployment (NAIRU) which is conceptually the joblessness price where inflation is steady.

It is unobservable and the price quotes utilizing analytical methods are highly depending on the presumptions and strategy taken.

As I have kept in mind often times in the past, the analytical accuracy for the well-known NAIRU estimates is notoriously bad, with wide common mistakes– such that they are essentially ineffective for identifying some details full employment level.

In addition, they are generally biased upwards, indicating that the mainstream depiction of full work associates a lot greater unemployment rates with that state than the method that I take.

The Financial institution of Japan’s technique is fairly orthodox, initially based upon estimating what they call the Labour Input Space and the Capital Input Gap.

They after that develop a heavy measure of these gaps to define a complete outcome void.

Then using actual GDP figures stemmed from the National Accounts, they can subsequently approximate the prospective GDP.

Why?

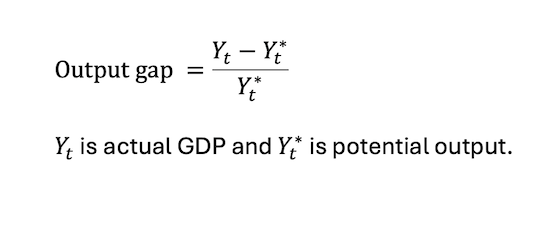

The result gap is defined in basic algebra as:

You don’t need to be a mathematician to be able to collaborate with this interpretation.

If actual GDP is 100 and possible GDP is 120, then the formula gives:

Output void = (100– 120/ 120 = -0. 166666667 or in portion terms – 16 7 percent.

That would certainly be a very large outcome space.

The Financial institution of Japan specifies the Work Input as:

The Financial institution’s potential Labour Input action uses the same expression “which ravels the

service cycle”.

What does that suggest?

I will not enter into the technical stuff yet primarily they utilize analytical devices to calculate a trend and assume this is the complete ability procedure.

The difference between this ‘fad’ input step and the actual step is the Labour Input space.

It is troublesome due to the fact that the trend may not refer a work level that pleases the desire for working hours of the available labour pressure.

They in a similar way compute a Capital Input space based on the distinction in between real capability utilisation prices and average utilisation prices.

There are all sorts of measurement problems faced in doing that.

However, for now, we simply presume these estimates have some level of applicability to the real life.

The reality that the Bank of Japan and the Ministry of Money utilize these estimates of the result gap in developing financial plan is an excellent factor for considering them, regardless of my worries.

They are likely to ignore the Labour Input void, which indicates we can consider them for argument purpose, to specify the tiniest void– with the fact lying above their quotes.

The most up to date information came out recently (October 3,2025

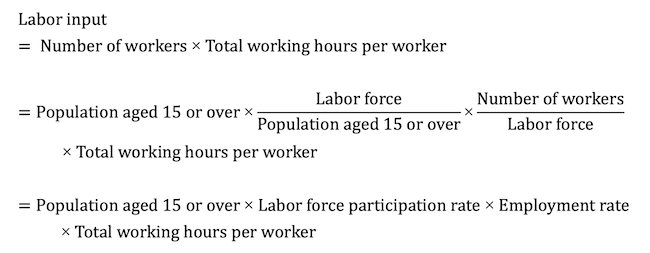

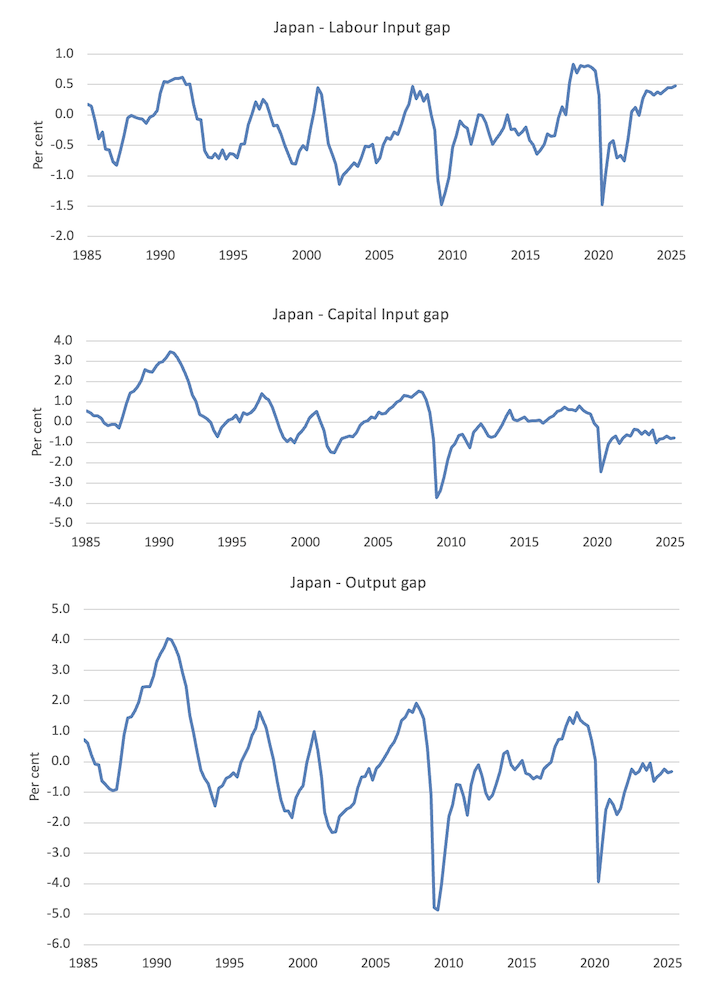

Here is a graph showing the Labour Input gap, the Funding Input space, and the complete outcome void between the March-quarter 1985 and the June-quarter 2025

As at the June-quarter 2025, the Bank approximates a result space of -0. 32 percent– fairly tiny.

They approximate the Labour Input gap to be +0. 47 percent, which implies the readily available work pressure is persuading their pattern possibility.

They approximate the Capital Input void to be -0. 79 percent, which indicates existing funding exercise is listed below its longer term average exercise.

So their quote of a little result space is based upon the concept that the economic climate might remove even more result out of resources supply by functioning it harder.

So according to these price quotes, there is some scope for raising real GDP growth utilizing increased net government investing, before tax offsets may be taken into consideration.

The inquiry though is just how to do that with the work ability currently well over possibility?

I am exploring that concern following.

And the context is that there is currently a growing enmity across the political divide for the intake tax.

I am informed that Ms Takaichi is supportive to the debate that this tax obligation could be minimized.

Verdict

An on-going research study job which will culminate in a significant occasion in the Diet plan in Tokyo on November 7, 2025

I will give more information of that event eventually.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Booked.